-

- 取引プラットフォーム

- PU Primeアプリ

- MetaTrader 5

- MetaTrader 4

- PU コピー取引

- ウェブトレーダー

- PU ソーシャル

-

- 企業の

- 規制

- 法的文書

- 補償基金

- クライアント資金保険

- ESG

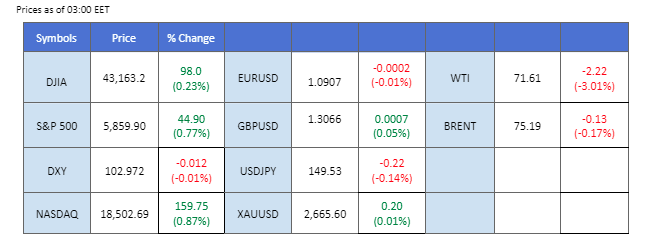

Market Summary

Wall Street extended its gains, with the Dow Jones and S&P 500 both continuing to reach all-time highs as the U.S. equity market enters the Q3 earnings season. Investors remain optimistic about corporate performance, fueling the ongoing rally. In contrast, the Chinese stock market struggled to find direction, with sentiment dampened by a perceived lacklustre economic stimulus package announced over the weekend. Additionally, China’s CPI reading fell short of expectations, causing further concern and a loss of confidence in the country’s equity market.

In the commodity market, oil prices plummeted during the last session, falling nearly 5% after reports surfaced that the Israeli Prime Minister is unlikely to target Iranian crude oil facilities. This relieved some market concerns over potential supply disruptions from the Middle East, leading to the sharp decline. Meanwhile, gold remained firm above the $2,650 mark, buoyed by ongoing geopolitical tensions not only in the Middle East but also in the South China Sea, where regional conflicts have intensified, potentially supporting the precious metal’s value.

In the forex market, the U.S. dollar maintained its bullish momentum, trading above the $103 mark, as traders anticipate a smaller Fed rate cut in the near term. The USD/JPY pairing is drawing attention, as it approaches the critical 150 level, a threshold that could prompt action from the Bank of Japan (BoJ) to stabilise the yen. Traders should monitor this level closely, as it could be pivotal for yen intervention or other policy shifts.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (7%) VS -25 bps (93%)

(MT4 System Time)

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

Due to a lack of market catalysts from the U.S. region, investors are revisiting previous economic news. The Dollar Index, which trades against a basket of six major currencies, has extended its gains while testing strong resistance levels. Investors continue to digest better-than-expected economic data, including the U.S. CPI and previous jobs report, leading to a waning of expectations for aggressive rate cuts. Moving forward, careful monitoring of Federal Reserve monetary policy and further economic data will be crucial to assessing potential movements in the dollar.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 70, suggesting the index might enter overbought territory.

Resistance level: 103.30, 104.05

Support level: 102.60, 101.70

Gold prices retreated slightly, primarily due to the appreciation of the U.S. dollar and stronger-than-expected overall U.S. economic performance. This dip can also be attributed to profit-taking and technical corrections after recent record highs. Despite mixed market catalysts, better-than-expected U.S. economic data may weigh on gold demand. However, rising tensions in the Middle East are shifting sentiment toward safe-haven gold. Investors should continue to monitor market developments, U.S. data, and geopolitical tensions in the region to gauge future movements in gold prices.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 48, suggesting the commodity might experience technical correction since the RSI rebounded from oversold territory.

Resistance level: 2670.00, 2690.00

Support level: 2645.00, 2630.00

The British Pound (GBP) has been trading sideways against the U.S. dollar following a sharp decline earlier this month. The pair remains under pressure, primarily due to the hawkish outlook from the Federal Reserve, which has bolstered the U.S. dollar and weighed on GBP/USD. While the Pound Sterling lacks significant drivers at the moment, traders will be closely watching tomorrow’s UK CPI reading for potential market direction. This key inflation report could serve as a catalyst for the Pound, providing insight into the strength of the U.K.’s economy and potentially influencing future Bank of England monetary policy decisions.

GBP/USD remains trading within its downtrend trajectory, but the bearish momentum is seemingly decreasing. The RSI is edging higher, while the MACD is approaching the zero line from the bottom, suggesting that the bearish momentum is easing.

Resistance level: 1.3140, 1.3220

Support level: 1.2990, 1.2910

The EUR/USD pair continues to edge lower, reaching its lowest level in two months. The euro remains under pressure due to dovish expectations surrounding the European Central Bank (ECB), with the central bank’s interest rate decision scheduled for tomorrow. Should the ECB opt for further rate cuts, it could weaken the euro even more against its major peers. In contrast, the U.S. dollar remains strong, buoyed by expectations of a more hawkish stance from the Federal Reserve as U.S. job data continues to reflect a robust labour market. This divergence in monetary policy outlooks is driving the EUR/USD lower.

EUR/USD is struggling to find support at its critical level at 1,0900. Breaking support at this level would be a bearish signal. The RSI is hovering close to the oversold zone, while the MACD edge is higher, suggesting the bearish momentum is easing.

Resistance level: 1.0950, 1.1020

Support level: 1.0890, 1.0805

The AUD/USD pair is hovering near the 0.6730 mark, lacking clear direction after a significant plunge earlier this month. Traders are now eyeing the Australian job data release on Thursday, which is expected to have a substantial impact on the Reserve Bank of Australia’s (RBA) upcoming interest rate policy and the strength of the Aussie dollar. As bearish momentum appears to be easing, a break above the 0.6740 level could serve as a potential trend reversal signal for the pair, indicating a shift toward a more bullish outlook.

AUD/USD is currently trading sideways, waiting for a catalyst to pick a direction. The RSI remains below the 50 level, while the MACD is edging higher and has formed a bullish divergence, suggesting a potential trend reversal for the pair.

Resistance level: 0.6780, 0.6850

Support level: 0.6670, 0.6610

U.S. stock index futures steadied in evening trades on Monday after a rally in technology shares pushed Wall Street to record highs. Key technology stocks, such as NVIDIA Corporation (NASDAQ: NVDA), surged by 2.4% to reach a record high. Aftermarket trading showed stability for NVIDIA, along with other tech giants like Apple Inc (NASDAQ: AAPL), Alphabet Inc (NASDAQ: GOOGL), and Microsoft Corporation (NASDAQ: MSFT), which also experienced gains during the session. Market attention will now shift to a series of upcoming earnings reports and economic readings that could influence market trends.

The Dow is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 70, suggesting the index might enter overbought territory.

Resistance level: 43440.00, 44900.00

Support level: 42420.00, 41400.00

Oil prices slid in early Asian trade following OPEC’s downward revision of its global oil demand growth outlook for 2024 and 2025. Additionally, reports surfaced indicating that Israeli Prime Minister Benjamin Netanyahu informed the U.S. that Israel is willing to strike Iranian military targets, not nuclear or oil sites, raising geopolitical tensions.

Oil prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 35, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 73.30, 75.35

Support level: 70.80, 66.75

FX、インデックス、金属どの取引を、業界最低水準のスプレッドと迅速な執行で行うことができます。

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!