-

- 取引プラットフォーム

- PU Primeアプリ

- MetaTrader 5

- MetaTrader 4

- PU コピー取引

- ウェブトレーダー

- PU ソーシャル

-

- 企業の

- 規制

- 法的文書

- 補償基金

- クライアント資金保険

- ESG

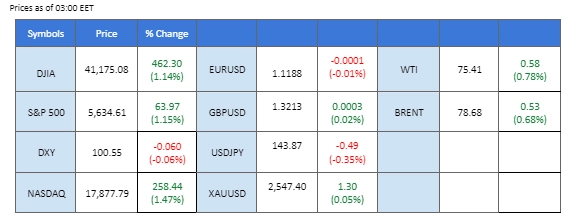

Market Summary

Jerome Powell’s highly anticipated speech last Friday at the Jackson Hole Economic Symposium drove the dollar to its lowest level since last July. The Fed Chair expressed concerns about the U.S. job market and indicated confidence that the inflation rate will reach the 2% target, suggesting a dovish stance from the U.S. central bank. This has increased the likelihood of a policy pivot in September. In contrast, Bank of England Governor Andrew Bailey acknowledged that inflationary pressures in the UK are easing but emphasized that it is still too early to consider rate cuts, resulting in the pound sterling rising to its highest level against the dollar since March 2022.

Traders are also looking ahead to Tuesday’s BoJ core CPI reading for insights into the Bank of Japan’s future monetary policy moves and their impact on the yen. In the commodities market, gold gained over 1% in the last session, buoyed by the weaker dollar. Meanwhile, escalating clashes in the Middle East between Hezbollah and Israel pushed oil prices up by nearly 3% in the last session.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32.5%) VS -25 bps (67.5%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The US Dollar Index, which measures the greenback against a basket of six major currencies, continues to decline sharply. This drop follows Federal Reserve Chair Jerome Powell’s clear signal that rate cuts are likely next month. While Powell did not specify the size of the cuts or the future path of easing, he highlighted progress on inflation and noted that the labor market’s health will guide future policy decisions. His comments sent US Treasury yields and the dollar lower, further supporting the equity market.

The Dollar Index is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum. However, RSI is at 25, suggesting the index might enter oversold territory.

Resistance level: 101.05, 102.35

Support level: 99.95, 99.25

The escalating Middle East tensions have fueled a surge in gold prices, as investors flock to safe-haven assets amid rising geopolitical risks. The depreciation of the US Dollar, driven by expectations of upcoming Federal Reserve rate cuts, has further supported gold’s bullish momentum. As the conflict intensifies, gold’s appeal as a defensive investment remains strong, with market participants closely monitoring developments for potential impacts on global stability.

Gold prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2495.00, 2535.00

Support level: 2465.00, 2445.00

The British pound strengthened in the last session, rising to its highest level since March 2022, as the dollar faced significant selling pressure. Bank of England Governor Andrew Bailey’s speech at the Jackson Hole Economic Symposium indicated that the central bank would likely keep interest rates elevated for an extended period. Bailey emphasised that it is too early to declare victory over inflation, suggesting that inflationary pressures in the UK may still persist. This stance has bolstered the pound, reflecting market expectations for a more prolonged period of higher interest rates in the UK.

GBP/USD jumped nearly 1% in the last session and reached its highest level in two years, suggesting a bullish bias for the pair. The RSI has been hovering in the overbought zone for the past few sessions, while the MACD has a bullish cross above the zero line, suggesting the bullish momentum remains strong with the pair.

Resistance level: 1.3280, 1.3350

Support level: 1.3140, 1.3065

The EUR/USD pair surged to a recent high in the last session, indicating a bullish bias for the currency pair. This gain was primarily driven by a softened dollar following a dovish speech by the Fed Chair at the Jackson Hole Economic Symposium. The Fed expressed concerns about the U.S. job market and conveyed confidence that inflationary pressures are under control, which has increased the likelihood of a rate cut in September. This dovish outlook has weighed heavily on the dollar, contributing to the euro’s strength against it.

EUR/USD jumped strongly after the pair recorded a technical retracement in the earlier session, suggesting the bullish trend remains strong. The RSI remains in the overbought zone, while the MACD has a higher high pattern, suggesting the bullish momentum is strong.

Resistance level: 1.1230, 1.1290

Support level: 1.1170, 1.1106

The USD/JPY pair declined by over 1% in the last session, reflecting the growing divergence between the monetary policy paths of the two central banks. The Bank of Japan (BoJ) is anticipated to continue tightening its monetary policy, while the Federal Reserve is increasingly concerned about the U.S. job market and is expected to start cutting rates soon. This contrast in monetary policy outlooks has contributed to the continued drop in the pair, with the yen strengthening against a weakening dollar.

The USD/JPY is heading to its previous low level, with bearish momentum gaining. The RSI is on the brink of breaking into the oversold zone, while the MACD has a bearish cross below the zero line, suggesting that bearish momentum is gaining with the pair.

Resistance level: 146.00, 149.20

Support level: 141.40, 138.90

Bitcoin (BTC) surged strongly on Friday, gaining over 5% as improved risk appetite in the financial markets was fueled by Jerome Powell’s dovish remarks at the Jackson Hole Economic Symposium. The cryptocurrency rallied to the $64,000 mark, its highest level in August, driven by growing expectations of a potential Federal Reserve rate cut in September. The prospect of looser monetary policy has boosted investor sentiment, encouraging a bullish momentum for BTC.

BTC has broken above from the uptrend channel, suggesting a bullish bias for BTC. RSi has broken into the overbought zone while the MACD continues to edge higher, suggesting the bullish momentum is gaining.

Resistance level: 67540.00, 70880.00

Support level: 61210.00, 57060.00

As US Treasury yields dipped further, buoyed by solidified expectations of September rate cuts, the overall US equity market found support. Looking ahead this week, investors will turn their attention to Nvidia’s earnings report on Wednesday. The market will be keen to see if the chipmaker can maintain its impressive earnings growth, fueled by advancements in artificial intelligence. Nvidia’s earnings and outlook could provide crucial insights into the state of AI demand and its potential ripple effects across the entire US technology sector.

Nasdaq is trading higher while currently near the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 62, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 20015.00, 20705.00

Support level: 19035.00, 17865.00

Crude oil prices have gained significant bullish momentum in response to the escalating conflict in the Middle East, sparking concerns about potential supply disruptions. The threat of renewed violence between Hezbollah and Israel, coupled with diminishing hopes for a ceasefire, has heightened market fears, dampening risk appetite and driving oil prices higher. As the situation remains volatile, investors are advised to stay vigilant for further developments that could impact global oil supply and demand dynamics.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the commodity might extend its gains after successfully breakout since the RSI stays above the midline.

Resistance level: 73.45, 78.55

Support level: 73.70, 71.75

FX、インデックス、金属どの取引を、業界最低水準のスプレッドと迅速な執行で行うことができます。

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!