-

- 取引プラットフォーム

- PU Primeアプリ

- MetaTrader 5

- MetaTrader 4

- PU コピー取引

- ウェブトレーダー

- PU ソーシャル

-

- 企業の

- 規制

- 法的文書

- 補償基金

- クライアント資金保険

- ESG

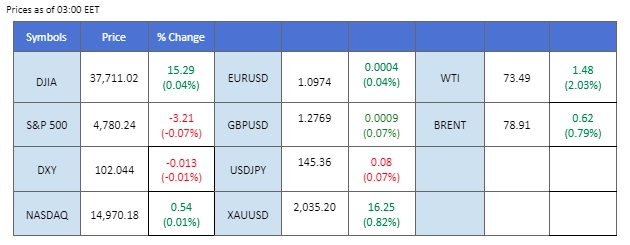

Oil prices experienced a significant rally, reaching their highest level in 2024, as geopolitical tensions heightened in the Red Sea. Following a retaliatory move by the U.S. against Houthi attacks on ships, airstrikes were launched, escalating tensions and raising concerns about potential disruptions in oil supplies. The U.S. dollar initially strengthened after the release of an upbeat U.S. Consumer Price Index (CPI), which came in at 3.4% (YoY), surpassing the previous reading. However, the dollar retraced as market speculation regarding a possible March Fed rate cut persisted. In the cryptocurrency space, Bitcoin (BTC) faced a brief surge to the $49,000 level, its highest since December 2021, before profit-taking sentiment led to a pullback. The crypto market continues to digest the SEC’s approval of the Spot BTC ETF, with BTC currently trading near the $46,000 mark.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

(MT4 System Time)

Source: MQL5

The Dollar Index staged an initial rebound, propelled by robust economic indicators, particularly the US inflation rate, which surpassed expectations. The Bureau of Labor Statistics reported a year-on-year Consumer Price Index (CPI) increase of 3.40%, surpassing both the November reading of 3.1% and the market’s 3.20% forecast. Despite doubts on an early interest rate cut, the focus now shifts to the Federal Reserve’s future monetary policy decisions.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 102.60, 103.45

Support level: 101.90, 101.30

Gold prices dipped initially on the Dollar’s resurgence post-positive economic data, but a cohort of market participants engaged in bargain-buying. The uncertainty stems from divergent expectations—some anticipating Fed easing despite economic strength, leading to a rebound in the gold market.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2035.00, 2055.00

Support level: 2020.00, 2000.00

The GBP/USD pair continued its upward momentum, maintaining its uptrend trajectory despite a brief rebound in the dollar’s strength. The U.S. dollar initially gained support from an upbeat Consumer Price Index (CPI) reading, registering at 3.4% last night. However, the dollar’s advance was short-lived as market expectations of a March rate cut remained prevalent. In contrast, the British Pound found strength following a hawkish statement from the Bank of England (BoE) governor, providing resilience for the Sterling against its currency counterparts.

The GBP/USD pair traded to its highest level in 2024, 1.2784, suggesting the uptrend momentum remains strong. The RSI gradually moved upward, approaching the overbought zone, while the MACD continued to flow above the zero line, suggesting the pair remained trading with bullish momentum.

Resistance level: 1.2815, 1.2906

Support level: 1.2728, 1.2631

The EUR/USD pair persisted in its uptrend trajectory despite a strengthening U.S. dollar fueled by a higher-than-expected Consumer Price Index (CPI) reading. The U.S. CPI, registering at 3.4%, surpassed previous figures, signalling persistent inflationary pressures in the U.S. Nevertheless, the euro’s strength appeared subdued, reflecting concerns over the eurozone’s economic outlook amidst recent lacklustre data.

The EUR/USD remains trading in an uptrend trajectory and is on the brink of breaking above its short-term resistance level at 1.0982. The MACD has broken above the zero line while the RSI has been moving upward, suggesting the bullish momentum remains strong.

Resistance level: 1.1041, 1.1138

Support level: 1.0866, 1.0775

The USD/JPY pair formed a higher high price pattern, briefly trading at its highest level in 2024, only to retrace as the U.S. dollar softened. The Japanese Yen has emerged as the weakest currency against its peers at the onset of 2024, influenced by shifting sentiments that the Bank of Japan (BoJ) may delay a monetary policy shift. Despite the Japanese Consumer Price Index (CPI) remaining above the BoJ’s 2% target rate, the central bank appears cautious, awaiting further evidence to ascertain the sustainability of inflation before making any policy moves.

The USD/JPY traded to its highest level in 2024, but the MACD has formed a bearish divergence, suggesting a bearish signal for the pair. The RSI has also retreated from the overbought zone, suggesting the bullish momentum has eased.

Resistance level: 146.88, 148.77

Support level: 143.82, 141.64

The AUD/USD pair continues to trade within a consolidation range, anticipating a catalyst to determine its direction. Despite the upbeat U.S. Consumer Price Index (CPI), the U.S. dollar failed to sustain a higher momentum, leading the AUD/USD pair to return to its established range following a brief retreat. Global economic signals contribute to the pair’s dynamics, with attention on downbeat Chinese CPI and Producer Price Index (PPI) data. The negative implications from these economic indicators highlight ongoing challenges in the Chinese economy, influencing the Australian dollar as a proxy currency.

The AUD/USD pair has been consolidating after a downtrend move, suggesting a neutral signal for the pair. The RSI has been slowly gaining while the MACD is approaching the zero line from the bottom, suggesting bullish momentum is forming.

Resistance level: 0.6797, 0.6894

Support level: 0.6617, 0.6510

Better-than-expected inflation reports have left the US equity market in a state of flux, clouding the outlook. Despite dovish signals from some Federal Reserve members, the market grapples with uncertainties over the central bank’s future decisions. Traders, initially pricing in aggressive rate cut expectations, now adopt a cautious “wait-and-see” approach amid conflicting signals.

The Dow is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 70, suggesting the index might enter overbought territory.

Resistance level: 37850.00, 39275.00

Support level: 36735.00, 35950.00

Crude oil prices rebounded, propelled by concerns over supply disruptions due to the Middle East crisis and a Libyan outage. Heightened tensions, with Israel projecting a prolonged conflict through 2024, amplify worries of a potential regional crisis affecting oil supplies. However, gains are tempered by the strengthening US Dollar, spurred by inflation data that may postpone an anticipated March interest rate cut by the Federal Reserve.

Oil prices are trading flat while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 74.00, 78.65

Support level: 67.40, 63.70

FX、インデックス、金属どの取引を、業界最低水準のスプレッドと迅速な執行で行うことができます。

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!