-

- 取引プラットフォーム

- PU Primeアプリ

- MetaTrader 5

- MetaTrader 4

- PU コピー取引

- ウェブトレーダー

- PU ソーシャル

-

- 企業の

- 規制

- 法的文書

- 補償基金

- クライアント資金保険

- ESG

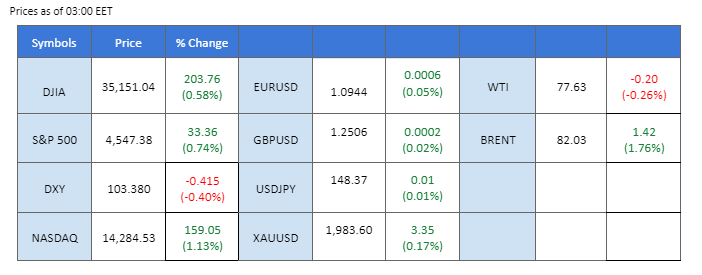

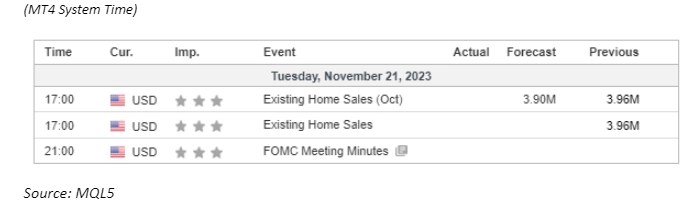

Recent market dynamics have seen a surge in risk-on sentiment, with global equities rallying fervently. The Nasdaq has ascended to nearly a two-year high, driven by heightened anticipation surrounding Nvidia’s upcoming earnings report. The Nikkei continues to trade at elevated levels, underscoring sustained positive market sentiment. Concurrently, the US dollar index has slid to its lowest point since early September, accompanied by a decline in US long-term bond yields. Adding to the market fervour, the Australian dollar strengthened against the US dollar following the release of the Reserve Bank of Australia’s November meeting minutes. The central bank’s acknowledgment of the inflationary risks associated with maintaining the current interest rate was perceived as a hawkish stance, contributing to the Australian dollar’s robust performance. Meanwhile, oil prices experienced a second consecutive session of gains, fueled by speculation that OPEC is poised to announce further production cuts in the upcoming weekend meeting.

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95.0%) VS 25 bps (5%)

The Dollar Index, gauging the dollar against major currencies, plunged to a more than two-month low, extending last week’s losses. Investor sentiment leans towards speculation that the Federal Reserve might adopt a more dovish stance in its monetary policy. CME’s FedWatch Tool suggests a 50% probability of a 25 basis points cut by May. The awaited release of meeting minutes from the Fed’s recent session will be closely scrutinised for insights into the Monetary Policy Committee’s potential policy adjustments.

The Dollar Index is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 31, suggesting the index might enter oversold territory.

Resistance level: 103.60, 104.05

Support level: 103.05, 102.50

Gold prices undergo a minor retreat, prompted by technical correction as the precious metal hovers around the $1980.00 resistance level. Some investors seize the opportunity to offload safe-haven gold, anticipating potential market volatilities surrounding the imminent release of the Federal Open Market Committee (FOMC) meeting minutes. However, dovish expectations from the Federal Reserve contribute to the depreciation of the US Dollar, bolstering the demand for safe-haven gold.

Gold prices are trading flat while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 58, suggesting the commodity might extend its gains after breakout the resistance level since the RSI stays above the midline.

Resistance level: 1985.00, 2005.00

Support level: 1965.00, 1940.00

The Cable has surged to its highest level in the past two months, surpassing the key psychological resistance level of 1.2500. This bullish momentum can be primarily attributed to the relative weakness of the U.S. dollar. Speculation is rife in the market that the Federal Reserve’s interest rates may have reached their peak. The recent solid bidding of the U.S. 20-year treasury indicates a market sentiment that suggests a potential deceleration in the previously aggressive campaign of interest rate hikes by the Federal Reserve. Such expectations of a more measured approach to rate increases have prompted concerns about the impact on the U.S. economy, potentially dampening the dollar’s strength in the process.

The Cable was forming a higher high price pattern and broke above its psychological resistance level at 1.2500, suggesting a bullish bias for the pair. The RSI remains at the elevated level while the MACD has continued rising, suggesting the bullish momentum is strong.

Resistance level: 1.2580, 1.2710

Support level: 1.2395, 1.2305

The Euro strengthened as expectations mounted that the European Central Bank (ECB) will maintain its rate hike cycle despite the Federal Reserve’s potential shift. Moody’s unexpected upgrade of Italy’s sovereign rating to stable and Portugal’s rating by two notches to A3 contributes to the positive outlook for the European region. Analysts suggest optimism about the economic progression in the region.

EUR/USD is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 75, suggesting the pair might enter overbought territory.

Resistance level:1.0950, 1.1065

Support level: 1.0835, 1.0750

The Nasdaq Composite climbed by 1.10%, continuing its bullish trend driven by positive sentiments in the US tech sector. Microsoft reached a record high after appointing Sam Altman to lead a new advanced artificial intelligence research team. Nvidia rose to an all-time high ahead of its quarterly results, with investors anticipating a positive impact from increased demand in AI. Easing expectations of tightening monetary policy also led to a slight dip in US Treasury yields, further fuelling demand for US equities.

Nasdaq is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 81, suggesting the index might enter overbought territory.

Resistance level:16375.00, 17000.00

Support level: 15780.00, 15190.00

The Australian dollar maintains its strength against the U.S. dollar, particularly following the release of the Reserve Bank of Australia’s (RBA) November meeting minutes. The RBA’s acknowledgement that inflation could persist if interest rates remain unchanged was interpreted as a hawkish stance by the market, bolstering the Australian dollar. Meanwhile, the U.S. dollar remains influenced by speculation surrounding the possibility that the Federal Reserve’s interest rates have reached their peak.

The AUD/USD pair has broken above its strong resistance level at 0.6510 level and continues to surge, suggesting a bullish bias for the pair. The bullish momentum remains strong, with the RSI staying near the overbought zone while the MACD remains at an elevated level.

Resistance level: 0.6610, 06710

Support level: 0.6390, 0.6300

Oil prices surged by over 2% as anticipation builds for additional supply cuts in the OPEC+ production. Sources indicate that the group is likely to discuss further cuts during its upcoming meeting on November 26. The prospect of stabilising oil prices amid a gloomy global economic outlook prompts attention to potential adjustments in oil supply cuts by the OPEC+.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 78.80, 80.75

Support level: 75.35, 72.60

FX、インデックス、金属どの取引を、業界最低水準のスプレッドと迅速な執行で行うことができます。

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!